A new app aims to revolutionize banking for many Egyptians, providing an online-only experience. The banking startup, named Telda, officially launched in April 2021 after securing a USD 5 million pre-seed, the biggest of its kind in the region. The capital was largely funded by the American firm Sequoia Capital, in its first venture into the Middle East and North Africa market, but is no means the firm’s first investment in tech; it has previously backed household names like Apple, Google, Oracle, YouTube, Instagram and WhatsApp.

Telda is the brainchild of Swvl’s co-founder and former CTO, Ahmed Sabbah and an ex-senior engineer at Uber, Youssef Sholqamy. The pair are bringing their background in application-based business to make further inroads into the blooming Egyptian tech sector.

While the government still doesn’t award licenses to totally independent ‘neo banks’, Telda has bypassed the law by teaming up (while insisting it is totally independent of) with a local bank, which is yet to be revealed. Like its logo (a simple sine-wave) suggests, Telda hopes to make waves in Egypt, especially among the more technologically literate young, with Sabbah explicitly stating that: “Telda is a financial brand built for Millennials and GenZ”.

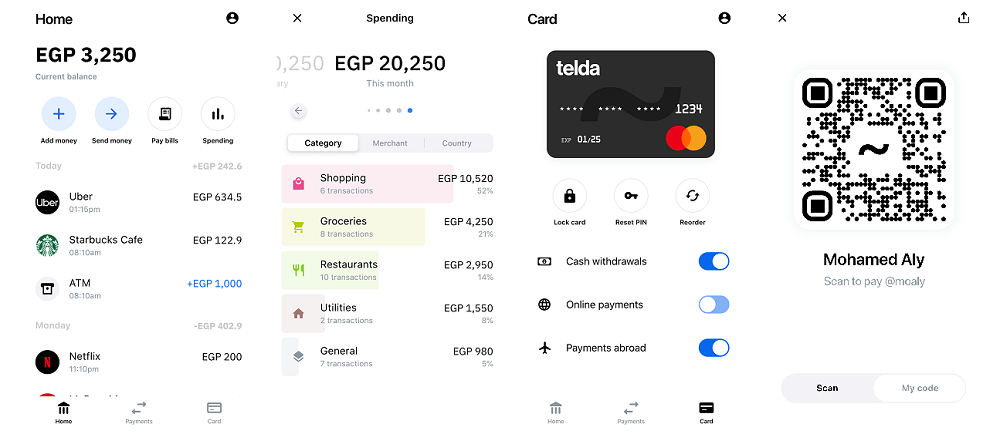

It seems to be working: within a month of its launch, 30,000 people had already signed up, with 17,000 on the waiting list for a card, that number has now more than doubled to 40,000. In the same month, Telda officially partnered with Mastercard – helping Mastercard to make further inroads into the Egyptian and wider Middle Eastern market. The partnership will allow users to obtain prepaid cards that can easily be used across the country and for online payments through Mastercard’s wide reaching network of payment services.

Though Telda is Egypt’s first, as they put it, “Money App”, it is following in the footsteps of large companies called “Challenger Banks” (online based non-traditional banks) which originated in the UK following the 2008 financial crisis, the biggest of which Revolut is now valued at $5.5 billion. However, some of these companies have struggled to make money through the banking model, like Revolut’s competitor Monzo (which is still losing millions of dollars over five years after their launch), which may act as a warning sign for Telda in the coming years.

Nevertheless, Telda is hoping that its simple sign up process, which only requires a national ID and mobile phone number, will attract many young people across the country who are eager to avoid the long queues and bureaucracy of traditional banks in Egypt.

Comments (9)

[…] Source link […]

[…] Egypt Welcomes its First Money App: Telda […]