According to the US Department of Commerce’s International Trade Administration, Egypt has the highest internet penetration rate in the Middle East and North Africa, with more than 50 million users, eight percent out of whom make regular online transactions. With an ever-growing telecommunications infrastructure and a large unbanked/underbanked population, Egypt is ripe for a Fintech boom of its own.

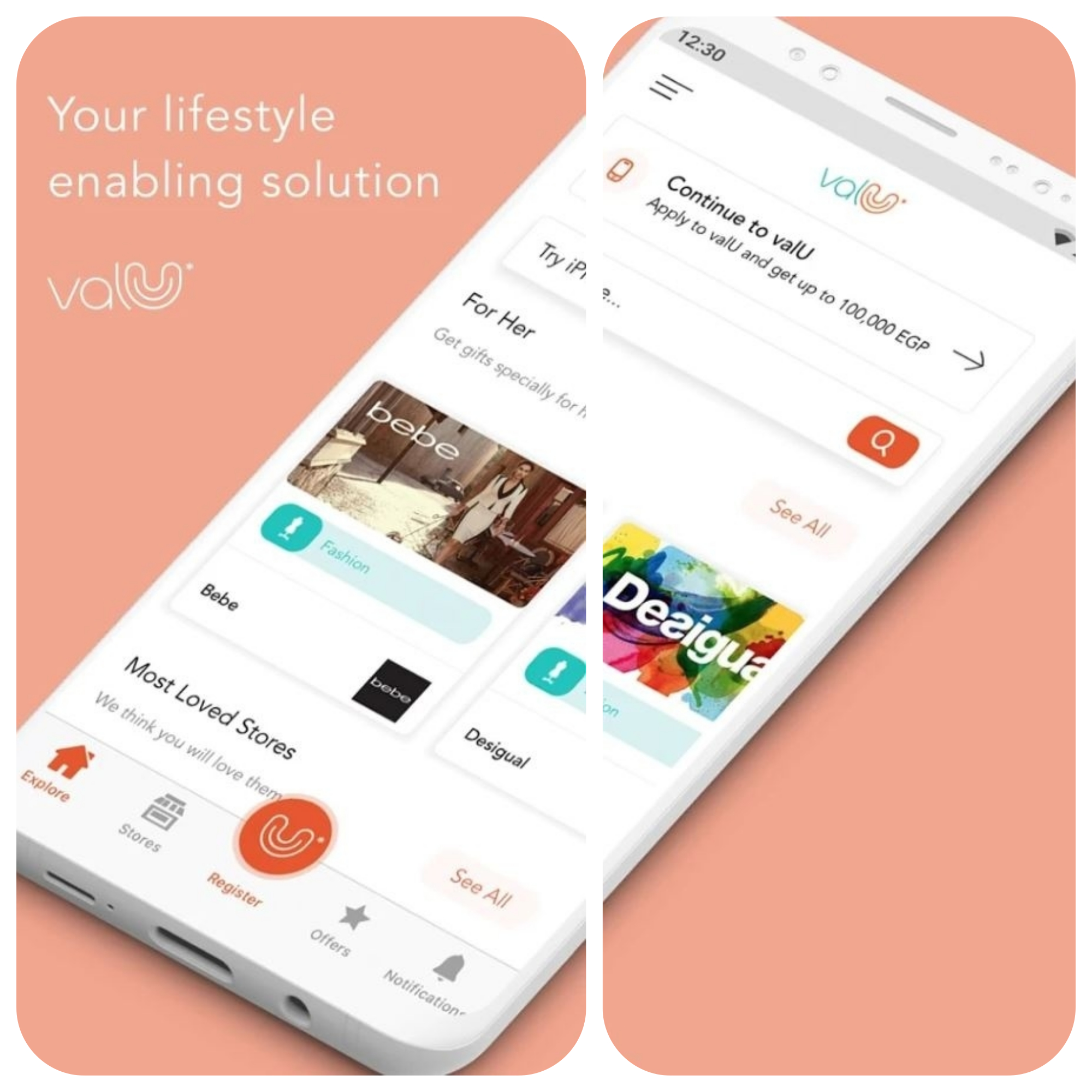

Cue valU, the mobile app that could very well render your credit card obsolete and winner of Terrapin’s Seamless Award for MENA Fintech Innovation of 2019, and the 2019 E-Commerce Summit’s Payments Award. Powered by EFG Hermes’s non-bank financial institution (NBFI), valU offers a financially innovative payment system that allows you to shop online and at thousands of retail stores and pay through an installment plan of your choice.

Using swipe-to-pay technology, the app allows users to perform transactions at any store in the valU network by swiping their smartphones over a POS (Point of Sale) device. The app also allows users to make transactions at a number of online marketplaces that support the service.

valU then generates a payment plan, complete with a timetable, through a built-in calculator and notifies users of upcoming payments. “What clients like the most about the app—apart from the shopping experience, is that they can select the payment plan of their choice, and clearly and with extreme transparency, see their monthly payments before concluding the purchase, how much interest and when they would pay and all of their upcoming payments,” valU Chief Business Officer Mohamed El Feky says.

Unlike most credit cards, however, valU offers an interest-free period of three months and up to 36 months for select stores, in addition to a wide array of payment methods for installments, from online to cash payments at their HQ or at any e-payment service provider, such as Fawry, Bee, Masary, Sadad, and Damen.

The groundbreaking app also bypasses the banking bureaucracy one must navigate in order to issue a credit card, setting a credit limit for each user based on a personal financial statement form.

“The average time it takes to get a credit card was shortened from 10 working days to six minutes…You download the application, apply for a shopping limit and you activate it by submitting your ID and driver’s license at any of our booths,” El Feky explains. “Once you activate your account, you swipe your phone on any of our approximately 3,000 points of sale, available in retail stores, health service providers, travel agencies and e-commerce websites [to make a purchase].”

Launched in December 2017, valU boasts a massive network of vendors across numerous categories, ranging from medical and health services, to beauty and fashion, all the way to furniture and home appliances, with an exclusive partnership with IKEA that allows users to shop at the furniture giant and pay through 24-month interest-free installment plans, or up to 48 months with the minimum interest in the market.

valU is a game-changing app that could potentially redefine Egypt’s consumer culture, and not only by streamlining the overall shopping experience, but also by making revolutionary products that were once inaccessible to most Egyptians readily available. Through a partnership with Karm Solar, valU offers low-interest payment plans on residential solar panels and other renewable energy assets.

With offices in Cairo and Alexandria, valU is building a financially inclusive model, extending its services to the sharing economy as well, through a partnership with Swvl to provide drivers with long-term vehicle loans.

But the question that inevitably arises when merging technology and finance is data protection, considering the lack of technological literacy on the part of many regulatory bodies. Being the most prominent app of its kind on the Egyptian market, valU has the ability to set the cultural and ethical standards for the country’s tech industry.

“Despite GDPR [the European Union’s General Data Protection Regulation] rules not applying to Egyptian data subjects, data processors or data controllers, we took preemptive steps to adhere to GDPR rigorously, in addition to ensuring that we follow the utmost standards (sic) for data security, client privacy and above all, ethics,” El Feky explains. “We do not share client data with third parties, affiliates or partners without clients’ consent in the first place and clients have the freedom to opt out.”

Learn more about valU by visiting their Facebook page. You can also download the app on your Android Phone or iPhone.

This is a sponsored article.

Comments (0)