“If I cannot pay for these infrastructural services from my own Egyptian bank, then I can’t really operate in Egypt. So I might as well just look for an environment where I can actually use my money however I please.” This is what Ramy Kandil, a 33-year-old Egyptian entrepreneur had to say about the recent decisions taken by Egyptian banks.

In October, Egyptian banks announced new restrictions on spending abroad, including suspending the use of debit cards in foreign currency. The decision came as an effort to halt the drain on foreign currency as Egypt’s foreign exchange currency shortage continues to worsen.

Shocking as it was, the decision was rebuffed by most Egyptians, especially young business owners and entrepreneurs.

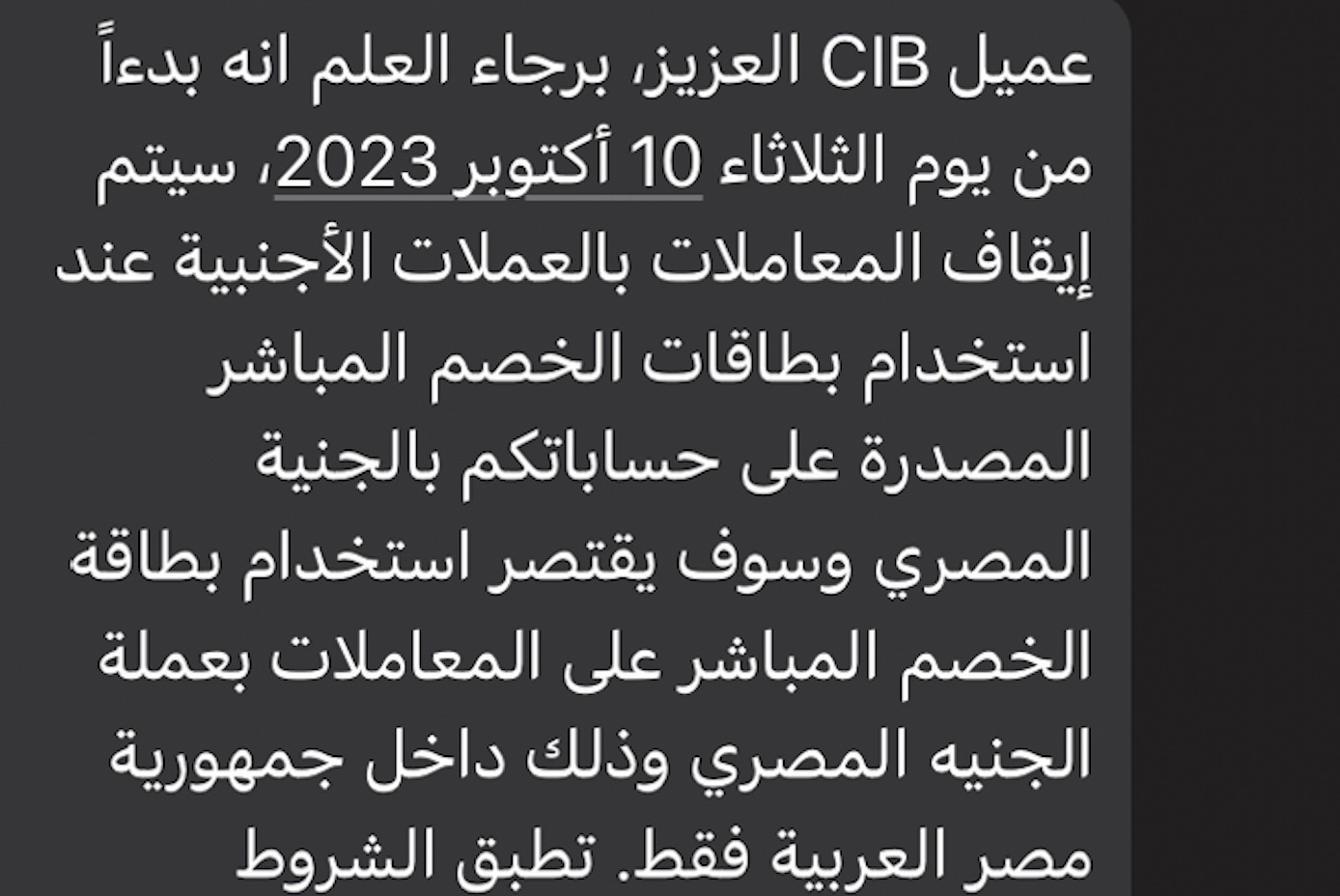

Through a short SMS, Egyptians were notified that they can no longer pay or buy any products or services in foreign currency, using their Egyptian bank cards, and that their cards can only be used for purchases charged in Egyptian pounds (EGP).

“The shocking part of it for me was the immediacy at which the decree was done. There wasn’t a month’s heads up, or a few months’ heads up, or any way for all these companies to prepare for this realistic change and how to do business. It was just a random SMS sent in the middle of the day, with such a huge decision being communicated, and effective immediately,” Kandil tells Egyptian Streets.

With over 13 years of experience in the field of advertising, Cairo-based Kandil established his own advertising agency three years ago. Since then, he has been struggling to sustain his business in a continuously-fluctuating economy.

With over 13 years of experience in the field of advertising, Cairo-based Kandil established his own advertising agency three years ago. Since then, he has been struggling to sustain his business in a continuously-fluctuating economy.

“Not one person came out with a proper statement to explain what’s happening, or how this affects companies. Until today, I, as a company owner, have not gotten an email from CIB,” Kandil snaps.

In the last few years, the Egyptian startup ecosystem saw unprecedented growth and expanded to include fintech, transportation, e-commerce, healthcare, real estate, among others.

Many of these companies, if not all of them, rely on services provided by organizations that are based outside of Egypt, most of whom only accept card payment.

“Ultimately, we do not exist in a vacuum as companies. All of the products that we use are not made by Egyptian companies, like Google Workspace, for example. These companies are invoicing you from Mountain View, California, or Ireland, or wherever. So, naturally, they’re invoicing in dollars, which already was a big burden on us with the currency dipping over the past two years by more than 50 percent,” Kandil says.

Ihab El-Sokary, co-founder and chief marketing officer of Amanleek, agrees. As a co-founder of a digital insurance startup which acts as an aggregator for insurance companies, El-Sokary highlights that they have multiple subscriptions that they struggle to renew and to subscribe for new services, in addition to digital channels that they use to market their services, such as Google ads, Facebook, and Instagram.

“Since the restriction was applied, [these companies] do not take the money in EGP by default. Our bank does not process the payment. We’re signed up for cloud solutions from Amazon, programs related to hosting, analytics tools that we need to pay for. And all that is online based,” El-Sokary tells Egyptian Streets.

“We rely on external, universal providers, like Google and Facebook, who are monopolies with no alternatives.”

It is no news that Egypt does not have its own version of Facebook or Google.

“If Egypt had created laws that forced Google to inhost locally from the Google Egypt office, just like they have a legal presence, then fine. Then it’s not a problem. The Egyptian government has not even made it a requirement for these companies to operate locally. They haven’t even endeavored to create that environment,” Kandil adds.

El-Sokary echoed Kandil’s calls that the Egyptian government needs to take into consideration that there are media buying and technology buying expenses that are not available in Egypt, “unless they can find ways to cooperate with them”.

Solutions, if any

Between sustaining their companies from their own personal money, and borrowing credit cards from their close circles and employees, young Egyptian entrepreneurs and business owners have been grappling with ways to manage their companies’ finances.

“We sent a message to our employees, telling them to help us if they own a credit card that they’re not using. And obviously, not everyone is open to the idea. Plus, not everyone has a credit card,” El-Sokary notes.

Generally, many startup owners find themselves more inclined to use debit instead of credit. From fostering unsustainable financial habits to overpromising clients, using credit cards to secure finances in a startup comes with its own set of risks.

“Working with debit, I know how much I’m working with, especially since some of our transactions are in foreign currency, which is already unstable,” Ahmed Yehia, Founder of Kay Creations, tells Egyptian Streets.

The EGP exchange rate against the United States Dollar (USD) has been constantly changing since the first devaluation after the start of the Russia-Ukraine war in March 2021. The Egyptian pound has lost nearly 50 percent of its value against the US dollar since then.

Way forward

Way forward

In 2022, Egyptian startups were able to raise finances amounting to USD 517 million.

Nevertheless, Yehia believes the government needs to offer more support to startups, investors, and entrepreneurs.

“You [the government] are supposed to offer a positive environment for me as a startup to compete with other countries, so that I would gain profit and bring you foreign currency, so you would eventually come out strong from the economic struggle that you’re facing, not impose limitations on me so my work would be less [productive] and eventually that would force me to explore establishing my business abroad and benefit another country’s economy, especially since I’m Egyptian and my entire team is Egyptian,” Yehia says.

Although Yehia is still reluctant to move his business out of Egypt, Kandil and El-Sokary have begun exploring options.

“We’re looking into different free zones, and different countries and markets. We’re looking at Ireland, the Netherlands, Estonia, the UAE, and the US,” Kandil adds.

Like many businesses, Amanleek, which has been Egypt-based since 2020, was considering expansion in Saudi Arabia and other Gulf countries, since they are booming markets and will boost their company’s presence. However, they initially wanted to better establish their business in Egypt first.

Unfortunately, the current economic conditions in Egypt are driving them towards accelerating the process of moving abroad and studying this step more seriously.

Meanwhile, the 32-year-old Egyptian entrepreneur, Yehia, describes this decision to restrict debit card usage as “a slow death”.

Yehia believes that the government is obligated to offer business owners the appropriate climate for their businesses to flourish because any decision that is not well-researched will affect both the business market and and the individuals benefiting from this market.

Competition from multinational companies and limited availability of angel investors and venture capital are only some of the challenges that Egyptian startups usually face. With an unstable economy, and incessant limitations and restrictions imposed on their finances, many fear this may lead to the end of the once-thriving startup ecosystem in the country.

Subscribe to the Egyptian Streets’ weekly newsletter! Catch up on the latest news, arts & culture headlines, exclusive features and more stories that matter, delivered straight to your inbox by clicking here.

Comments (0)