Egypt is poised for a significant increase in tax revenues for the 2024-25 fiscal year, starting July, driven by austerity measures mandated by the International Monetary Fund (IMF) and other international creditors in exchange for over USD 50 billion (EGP 2.3 trillion) in financial assistance.

The draft budget for the 2024-25 fiscal year outlines a projected 32 percent rise in tax revenues, reaching EGP 2 trillion (USD 42 billion). This follows a 38 percent increase between the current fiscal year and the previous one, despite the income tax exemption threshold being raised to EGP 60,000 (USD 1,260.6).

Key factors contributing to the revenue surge include a 32.4 percent increase in VAT revenues and a 31.6 percent rise in income tax revenues. Revenue from the Suez Canal is also expected to jump, as the depreciation of the Egyptian pound to over 47 to the US dollar inflates the value of dollar-denominated canal tolls in domestic currency, according to Chairman of the Suez Canal Authority (SCA), Osama Rabie.

VAT revenue is set to nearly double over four years, from 339.7 billion pounds in 2020-21 to a projected 720 billion pounds in 2024-25. Income and capital gains tax revenues, encompassing levies on government employees, private sector workers, capital gains, and corporate profits, are expected to rise to EGP 782 billion (USD 15.18 billion) next year from 594.4 billion (USD 12.54 billion) this fiscal year.

This increase is driven by a projected 52 percent rise in taxes from the Suez Canal to EGP 157.2 billion (USD 3.32 billion), a 26.4 percent rise in tax revenues from government salaries to EGP 170.6 billion (USD 3.59 billion), and about a 30 percent surge in corporate tax revenues from oil companies and foreign partners.

Property tax revenue is projected to increase by 34 percent to EGP 232.7 billion (USD 4.89 billion), primarily due to higher levies on government debt instruments and a 32.3 percent rise in vehicle and driver’s license taxes. Revenues from cigarette and tobacco taxes are also set to increase by 21.4 percent to EGP 410 billion (USD 8.64 billion), while duties on carbonated and flavored water are expected to rise by 25.8 percent to EGP 8.2 billion (USD 172.84 million).

Taxes on water, electricity, gas, and telephone contracts, as well as butane gas consumption, are anticipated to rise by 25 percent. Levies on entertainment venues are expected to surge 320 percent, and fees on passports by 132.9 percent.

On the international trade front, tax revenues are projected to rise by 84.1 percent to EGP 179 billion (USD 3.77 billion), driven by a 70.8 percent increase in customs duties and a 78.7 percent rise in various fines.

Minister of Finance, Mohamed Maait, emphasized that tax rates have not been increased, particularly for foreign investors, and that the anticipated revenue rise is attributed to modernizing the tax system, expanding the tax base, combating evasion, integrating the informal economy, and taxing e-commerce.

The surge in tax revenues coincides with the government cutting back on food, fuel, and education subsidies, and selling state assets as part of a broader economic reform program agreed with the IMF for an USD 8 billion (EGP 380 billion) loan deal.

An IMF delegation is currently in Cairo for the third review of Egypt’s reform program, which could release a third tranche of USD 820 million (USD 38.95 billion) if the fund is satisfied with the progress.

These austerity measures have sparked discontent among Egyptians, who are already struggling with record-high inflation. Parliament recently passed a controversial law allowing private companies to manage public hospitals, inciting fear among lower-income citizens who rely on affordable healthcare.

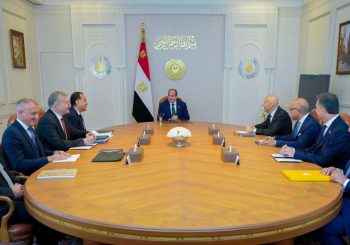

President Abdel Fattah Al Sisi, addressing the economic challenges in a recent speech, asked citizens to brace for further hardships, citing rapid population growth and rising subsidy costs as key strains on the country’s resources.

Proposed measures, such as mixing corn into subsidized bread to save USD 400 million (EGP 19 billion) to USD 600 million (EGP 28.5 billion), have been criticized as short-term fixes that fail to address the structural issues underlying Egypt’s economic crisis.

Comment (1)

[…] post Egypt Projects Sharp Increase in Tax Revenue Amid Austerity Measures first appeared on Egyptian […]