I would like to buy a house.

This thought has been floating around my mind for a while now. As a young adult in my late twenties, it feels as though it should somehow be feasible for me to become a homeowner. The harsh reality of the situation however – especially as a young adult in Egypt – is that it is no where near feasible. Not anytime soon at least.

I would like to buy a house for a variety of reasons – for my own sense of security, to have my own space, perhaps even to have a place where my mother could eventually reside. No matter what the reason may be, I should be able to at least have the option of purchasing my own home at this point in time.

Current market prices however, for a half decent home (even a simple two bedroom apartment) in a decent Cairo neighborhood are far too high – always hovering in the millions – for me to even think about being able to meet a downpayment, just a downpayment. Not to mention that current average monthly salaries do not exactly facilitate or aid such processes.

While becoming a young homeowner is not exactly feasible in Egypt, it is also not entirely feasible all over the world. This comes as a result of a mixture of many different factors that have taken shape throughout the years.

How Owning a Home Has Shifted in Perspective Over Time

The reality of things now is simply that less and less millennials are looking to own a home. Most young adults these days settle for renting a home, while those in the MENA region usually live in their parents’ homes up until marriage.

According to a 2018 article on Urban Institute, “Our new, extensive Millennial Homeownership report finds that the homeownership rate of millennials between the ages of 25 and 34 was 37 percent in 2015, approximately 8 percentage points lower than the homeownership rate of Gen Xers and baby boomers at the same age.”

It is a fact that millennials are not as set out to own a home as their parents were at their age, and it is most probably also because of the simple fact that times have changed. People are getting married later now, people are more career driven and many Western young adults also face debt after college.

Owning a home these days is simply not a priority for most millennials – and besides, a lot of millennials’ parents have already handled the situation for them by purchasing homes for their children ‘to get married in’ (or possibly even simply for security reasons). But where does that leave those who do not have a home waiting for them to move into?

The Evolution of the Economy: Salaries vs. The Real Estate Market

As priorities and perspectives have shifted over time, so has the economy – quite drastically even perhaps. In this day and age, almost everything costs more. The real estate market in specific however, is drastically more expensive.

In the meanwhile, as prices for commodities around us go up, salaries seem to be going down. The average income for a fresh graduate these days may be anywhere around 6,000 EGP (if not less). With a monthly income of this rate, even with annual increases and bonuses, it would still have to take multiple years of saving to be able to gather enough money for a mere downpayment on any of the properties currently being advertised.

According to an article published in April 2020 entitled Breaking Down Egypt’s Real Estate Market in 2020, “it is expected that Egypt’s property market will flourish, but the sales will remain low till the end of the first quarter of the ongoing year. This is due to the inequality of the percentage between what is offered and the citizen’s purchasing power.”

While the real estate market in Egypt in recent years seems to have been somewhat unstable for a variety of reasons, a big factor also happens to be the citizens’ purchasing power; not to mention the fact that when they refer to citizens’ purchasing power, they are refering to citizens under a particular age bracket and income level.

Even in the UK however, studies have shown that ‘home ownership among young adults has collapsed’. According to this 2018 article in The Guardian, “New research from the Institute for Fiscal Studies shows how an explosion in house prices above income growth has increasingly robbed the younger generation of the ability to buy their own home.”

It is absolutely abysmal that as millennials, we are not only getting robbed of our rights to a decent monthly income that can both offer a sustainable living experience and the ability to have some savings – this is a whole other issue that needs to be discussed on its own – but also of our rights and abilities to build ourselves a life, without having to rely on anyone else.

However, it is definitely worth noting that not everyone feels this way.

Owning a Home Means Marriage

The thing is, owning a home comes with its own set of cultural differences around the world. In Egypt for example, most young adults don’t worry about being able to own a home because of the fact that their parents will most likely have already bought them one.

In Egypt, it is custom for parents to buy their sons a home that they will eventually move into after marriage and so even families with daughters somewhat rely on this, as their daughter will eventually marry and move into her husband’s home.

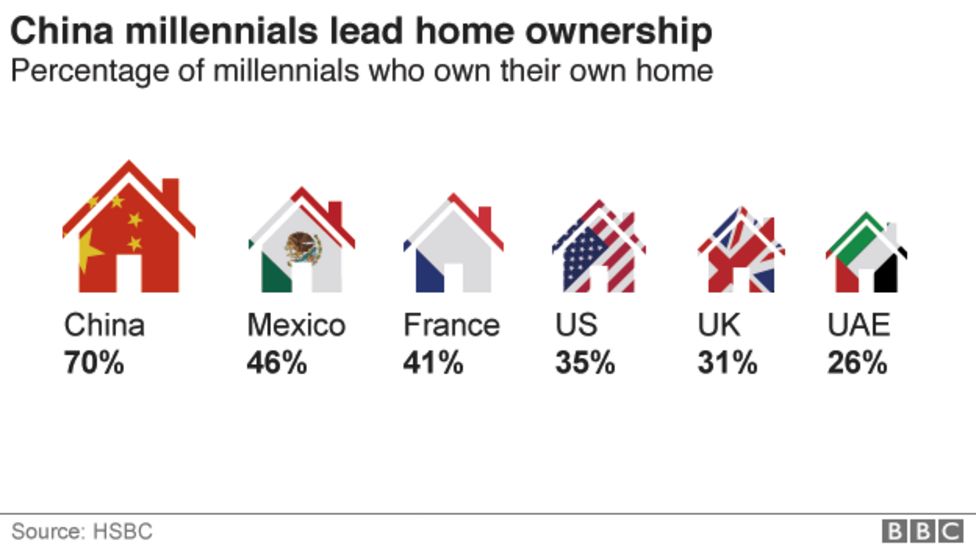

Even in this 2017 BBC article that looks at percentages of young adults who are home owners around the world, they found that 70 percent of Chinese millennials are homeowners; while this is a surprisingly high percentage, when looking at reasons why more closely they later state that, “For sons in particular, it’s down to the Bank of Mum and Dad – and underpinned by the marriage market… Chinese parents know their sons’ chances of marrying well are materially increased if they own a home.”

While home owning is very much intertwined with marriage in many places around the world, and evidently so in Egypt, perhaps we should consider the fact that owning your very own home can come to mean so much more and hold so much more value than simply doing it for the purpose of marriage.

Of course, there is nothing wrong with purchasing a home for the purpose of marriage, however what if we look at home-owning from the perspective of making a smart personal investment. After all, you never know when owning your own home will come in handy.

I am a millennial, and I would like to buy a house.

*The opinions and ideas expressed in this article do not reflect the views of Egyptian Streets’ editorial team or any other institution with which they are affiliated. To submit an opinion article, please check out our submission guidelines here.

Comments (3)

[…] The Impossibility for Young Adults to Become Homeowners in Egypt […]

[…] The Impossibility for Young Adults to Become Homeowners in Egypt […]